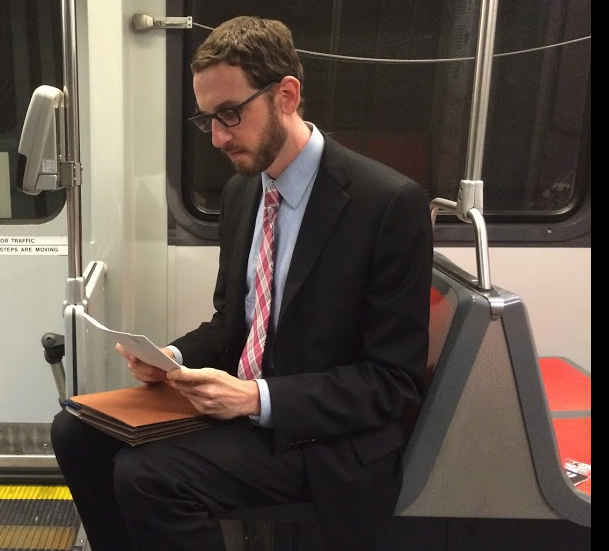

by Brian Leubitz

Sen. Scott Wiener (D-SF) announced plans for a California estate tax to partially replace the one repealed by the Republican Congress in DC. Under the plan, the approximately $1 Billion would go towards income inequality issues, where California leading the nation in the dubious category.

Sen. Scott Wiener (D-SF) announced plans for a California estate tax to partially replace the one repealed by the Republican Congress in DC. Under the plan, the approximately $1 Billion would go towards income inequality issues, where California leading the nation in the dubious category.

“It’s a way of not having a permanent nobility in the U.S.,” Wiener said. “We should help low-income, working families accumulate wealth so that they can send their kids to college, so that they can buy a home, so that they don’t go bankrupt if they have an unexpected medical expense.” (SF Chronicle)

The estate tax does just that: it reduces the “monied families” of our nation, and is was one of our country’s most effective means of reducing income inequality. But alas, the Republicans crowed about family farms being lost to the estate tax, which is just an old debunked myth that they keep trotting out, and repealed the tax entirely in the Trump tax scheme to save his family some money.

And the estate tax gets results. According to the CBPP, “evidence shows the estate tax likely has little or no impact on overall private saving, and it has a positive impact on overall national (private plus public) saving because of the revenues.”

Unfortunately, those revenues are not to be after the Trump family rescue plan was passed, but Sen. Wiener and the Democrats here in California are hoping to put an estate tax on the ballot for the presidential election next year. It will not bring that money back, nowhere near it really, but at least California can do its own small part.

You must be logged in to post a comment.