Some California Leaders had some thoughts.

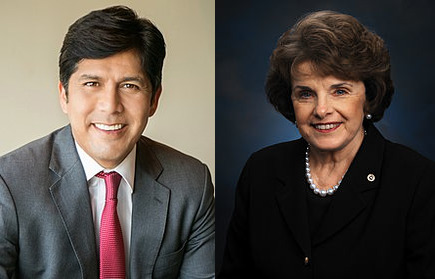

Sen. Harris:

Senator Feinstein:

“It’s unbelievable the lengths that Republicans will go to give the richest Americans a huge tax cut. The Republican tax bill will likely increase the deficit by $1.5 trillion and slash key deductions and credits for working families in order to give the richest Americans and large companies a tax cut.

“I’m particularly concerned about limitations on essential tax provisions that benefit working families and the middle class. This bill would harm families and is a non-starter for me, and I’ll fight to defeat it in the Senate.”

Mortgage Interest Deduction

The Republican bill caps the mortgage interest deduction for new home purchases at $500,000. All told, 18 counties in California have median home prices above $500,000 including Alameda, Contra Costa, Los Angeles, Marin, Mono, Monterey, Napa, Orange, San Benito, San Diego, San Francisco, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Sonoma and Ventura.

“Owning a home is an essential part of the American dream. Capping the mortgage interest deduction could create a huge barrier to homeownership and depress existing home values across the country.”

Sales and Income Tax Deductions

The Republican bill eliminates the deduction for state and local income taxes. In California, 5 million households claimed the income tax deduction in 2015.

“Ending this important deduction for the middle-class would mean income could be taxed twice and could lead to the reduction in critical state and local services. Republicans should scrap this one-sided effort and work with Democrats to pass true tax reform that ensures working families aren’t hurt and everyone pays their fair share.”

Minority Leader Pelosi did a Facebook live event. In a previous event, she had this to say of her 14 Republican California colleauges:

“We would hope that our colleagues would use their numbers – 14 – to influence the Republican leadership to take this out of the bill – and a bill that’s a disaster in so many other respects as well,” Pelosi said. “But short of that, we indict them for causing great harm to their constituents, financially, community-wise and to our great state.”

“Are they so weak that 14 of them could not weigh in and say, ‘This is not right for the future of our country’?” she said. “Have they no power? Have they no influence with the Republicans?”

House Majority Leader Kevin McCarthy, who apparently forgot to add the caveat, “except for Californians.” He has a twitter video here.

“Every single American is going to keep more of what they earned.”

Speaker Rendon:

“The dangerous Trump-Ryan-McConnell tax plan throws California taxpayers under the limousine. Under the rushed-together Republican tax plan, hardworking Californians could pay up to 22% more to subsidize tax breaks for billionaires and big corporations. Cutting the mortgage deduction in half hurts homebuyers and the housing industry. Proposition 13 lowered California property taxes, but the Republican tax plan effectively raises the property tax for many California homeowners. Adding insult to injury, the Republican tax plan makes Californians pay taxes on taxes we already pay. Whether it is students with loan debt or builders trying to create affordable housing, millions of Californians will be harmed by the Republican tax plan. No member of Congress from California can support this plan and look their constituents in the eye.”

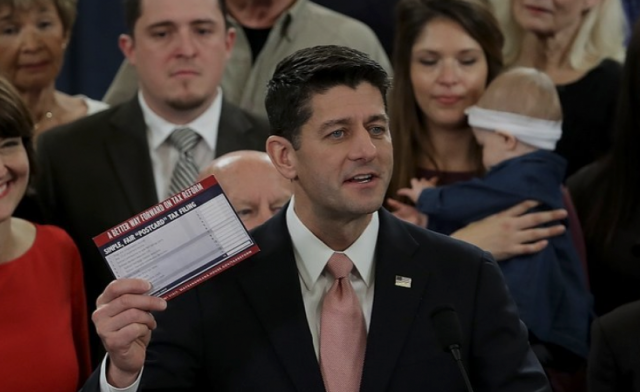

Rep. Mark Takano on Speaker Ryan’s plan – (D-Riverside)

Rep. Mark Takano on Speaker Ryan’s plan – (D-Riverside)

“The House Republican tax plan is a massive transfer of wealth from Californians and middle-class families to wealthy individuals and large corporations. Limiting deductions for state and local taxes, capping the mortgage interest deduction, and eliminating the student-loan-interest and medical-expense deductions are all policies that are specifically designed to hit Californians, who already contribute more to the federal government than they receive.

“The winners in this plan are the small percentage of people who already possess the largest share of our country’s wealth. Repealing the estate tax benefits only those with greater than $5.6 million in assets. Repealing the alternative minimum tax would allow wealthy individuals to avoid paying their fair share, including President Trump, who would save millions of dollars if this provision is passed into law. And permanently cutting the corporate tax rate to 20% from the current 35% would only benefit the corporations that are already enjoying record profits.

“Shifting money from middle-class Californians to the wealthiest individuals and corporations in America is bad policy in any environment. But given the severe inequality in our country and the struggle many working families face every day, this plan is simply indefensible.

“I strongly oppose this legislation and don’t see how any California Republican could support it.”

DNC Spokesperson Vedant Patel ahead of a Mnuchin visit to Corona to shill for this joke:

“Despite widespread agreement that the Trump-Republican tax plan would actually raise taxes on many middle class families, Donald Trump’s loyal puppet Secretary Mnuchin is jetting off to California to pitch his boss’s damaging proposal. As one of the many multimillionaires in Trump’s Cabinet, Secretary Mnuchin stands to profit immensely and can’t – or won’t – comprehend the catastrophic consequences for California’s working families if this tax plan becomes law. While Secretary Mnuchin tries to sell this sham tax bill, we hope that he avoids using any chartered flights that could cost the American taxpayers more in addition to what this disastrous tax plan will.”

Rep. Mark Takano on Speaker Ryan’s plan – (D-Riverside)

Rep. Mark Takano on Speaker Ryan’s plan – (D-Riverside)

You must be logged in to post a comment.