Calbuzz continues shilling for the California Commission on the 21st Century, or as I’ve called it the Latvia option, the plan to craete a flat income tax and massively transfer wealth upward from the middle class to the ultra-rich. Apparently,there are two packages on the table, which I’ll label CRAP and CRAAAAAP.

The first package to be considered has these key elements:

• Flattening the progressive, steeply-stepped state income tax rate system to a structure with essentially one rate of about six percent.

• Eliminating the state sales tax (local sales tax levies that have been approved for special purposes like transportation would remain in effect).

• Eliminating the corporation tax.

• Imposing the business receipts tax. It would be assessed on nearly every business in the state as a percentage of its gross revenue – minus the cost of goods and services that it purchases from other companies.

• Charging a “carbon tax” on gasoline, diesel and jet fuel, calculated at the refinery at $20 per ton of carbon emissions. This would amount to about 18 cents-per-gallon of gas.

The second scenario would flatten the income tax structure, but not include the receipts tax.

It’s comical to hear Calbuzz call our state income tax “steeply stepped.” There are NO tax brackets between $47,500 and $1,000,000. That’s a ridiculous statement. Progressives may appreciate the carbon tax, but clearly this proposal – especially if the business receipts tax gets excised, which considering the influence of Big Business on the process is almost assured – would make the overall tax structure in California MASSIVELY regressive, probably canceling out the progressivity of the federal tax structure.

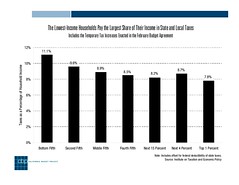

We already have a totally regressive tax system in California when you look at the effective tax rate – what people actually pay. The lowest 1/5 pay 11.7% of their income in taxes to the state, while the richest 1/5 pay 7.1%. And recent budget deals have only made the system more regressive. Now we’re planning to completely shift the tax burden to the poor and the middle class.

For example, one option would – among other things – establish a 6 percent “flat tax” that would apply to taxpayers whether they had incomes of $10,000 or $10 million. Under this scenario, the share of taxes paid by middle-income Californians – those with incomes between $20,000 and $50,000 – would more than double, while the share paid by taxpayers with incomes of $200,000 or more would drop by almost one-third. Flattening personal income tax rates also would increase the share of income that California’s low- and middle-income households would pay in taxes – exacerbating an already regressive tax structure […]

By increasing the share of taxes paid by low- and middle-income Californians, the tax packages under consideration would widen after-tax income gaps. Yet the level of inequality in California is already large and growing larger. The average taxpayer in the top 1 percent had an adjusted gross income (AGI) – income reported for tax purposes – of $1,832,123 in 2007 – 50.7 times that of the average middle-income taxpayer ($36,115). California’s income gap has been widening for years. The latest Franchise Tax Board data show that one-quarter (25.2 percent) of total AGI went to the wealthiest 1 percent of taxpayers in 2007, nearly twice the share (13.8 percent) in 1993, which is the earliest year for which data are available. In contrast, taxpayers with incomes in the middle of the distribution had just 10.0 percent of AGI in 2007, down from 13.0 percent in 1993. This means that the top 1 percent of taxpayers received approximately 25 times their proportionate share of AGI in 2007, while middle-income taxpayers received half their share. These disproportionate gains translate into a substantial concentration of income at the very top of the distribution. If the share of income going to the wealthiest 1 percent of taxpayers had remained the same since 1993, the bottom 99 percent of taxpayers would have an additional $123 billion in income – equal to $8,388 for each taxpayer.

To the extent that ordinary Californians are overtaxed, it’s because the system is completely unfair and designed to support the rich getting richer. And Calbuzz thinks that’s dandy, calling it a “major accomplishment” for the Governor, which of course it is – for his wealthy pals and contributors.

The May 19 election’s intent from the voters is obscure, although I agree with the leading pollsters in the state that “no new taxes” was certainly not the message. But I want to know what majority you can find out there that, as a result of the election, endorsed eliminating the corporate tax rate and delivering a Steve Forbes-style flat tax that has destroyed almost all of Eastern Europe. You can’t. This is a shocking power grab and people had better wake up to it.

As a postscript on Latvia, I noticed yesterday that their health minister quit in the face of having to accept severe budget cuts imposed by the IMF as a condition of providing loans. Food for thought.

It has horrible effects because it means even a business that is losing money may have a tax burden. If implemented as stated, it would also encourage outsourcing and 1099 employment rather than employees, since it talks about subtracting ‘goods and services purchased from other companies’.

Some companies make 1% margin on very large grosses, and some make big margins on small grosses. Net income is a much more appropriate measure.

I note that most people think that “flat tax” means that you would be taxed on gross income at some flat rate. They really don’t understand that the complexity isn’t in tax brackets, it’s in deciding what counts as income.

…to vanish is this sort of lunacy goes into effect.