California has been one of the hardest-hit states by the foreclosure crisis. There are many reasons for this – we were ground zero for the “creative” lending practices of the Bush years, as exotic and frankly stupid loans were offered to folks in order to blow an enormous asset bubble centered in the inland exurbs.  When gas prices parked themselves above $3/gal in 2006 the bubble finally burst, leaving hundreds of thousands of households unable to pay their mortgages and leading to massive unemployment in the inland counties.

When gas prices parked themselves above $3/gal in 2006 the bubble finally burst, leaving hundreds of thousands of households unable to pay their mortgages and leading to massive unemployment in the inland counties.

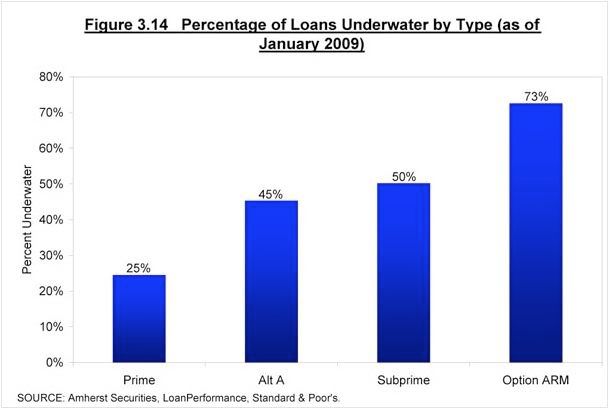

As bad as this has already been, the foreclosure crisis in California is likely to grow much worse in the coming months. Over at Daily Kos gjohnsit digs up some charts from the Boston Federal Reserve on the Option ARM, a popular loan in the mid-’00s that is now at the center of the rising number of foreclosures–>

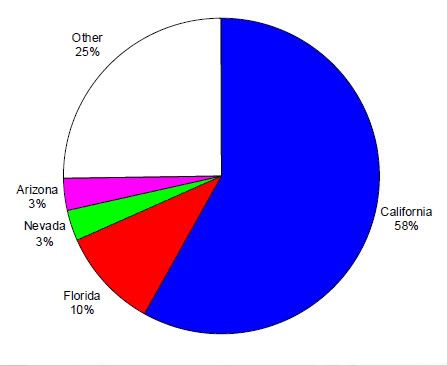

gjohnsit discussed predictions that nearly 90% of Option ARM could wind up underwater before long. This would primarily impact us here in California, where the Option ARM was most commonly used:

Already we are seeing increased foreclosures in Orange County:

At the end of last month there were 8,108 outstanding foreclosure auction notices in Orange County, nearly double the total a year ago, and up 9% from June, reports ForeclosureRadar.com….

It’s incredible that outstanding auction notices are essentially double a year ago. In fact, ForeclosurerRadar says actual foreclosures by month peaked in July 2008 with 1,444 houses and condos seized. So even though actual foreclosure totals by month have dropped, the inventory of potential foreclosures has continued to rise.

Foreclosures cause massive economic dislocation, and most folks realize government policy ought to be oriented toward their prevention. But so far those policies have failed. Banks have been given massive injections of public capital and are sitting on it. Cramdown legislation failed in Congress and Obama’s measures have benefited fewer than 10% of homeowners facing a foreclosure. California’s foreclosure moratorium merely postponed the inevitable.

So perhaps it is time for more dramatic solutions. Dean Baker has been talking about one of these for several months now, and in last week’s Los Angeles Times, revived his concept of the the “right to rent”:

It’s time to try a new route for helping homeowners. There is a simple alternative: Congress can pass legislation that gives homeowners facing foreclosure the right to stay in their home as renters. This “right to rent” policy would require no taxpayer money, no new bureaucracy and could immediately benefit homeowners facing foreclosure.

The basic idea is simple. In recognition of the extraordinary crisis, Congress would give families that took out mortgages at the peak of the boom and are facing foreclosure the option to remain in their homes as renters for a substantial period of time — five to 10 years — while paying the market-rate rent. Earlier this year, Freddie Mac launched a similar policy, giving former homeowners the option to lease their recently foreclosed properties, but on a month-to-month basis. That was a positive step, but it does not give families the housing security they need….

Although they would lose ownership of their homes under “right to rent,” the residents would be able to stay in their homes, neighborhoods and schools. This would provide families facing foreclosure with needed stability and housing security.

The concept is something of a cross between a triage and an intervention in the housing market. Baker believes that the “right to rent” would enable some to become long-time renters, which is an increasingly popular position among Californians as a strategy to wait out the crash while keeping a roof over their head. Given the costs to household bank accounts, to cities and neighborhoods, and even to the banks of people leaving their homes to foreclosure, there are sound policy reasons to want to keep people in their homes.

Dean Baker also argues the “right to rent” would help keep more people in their homes as outright owners, as banks would have new incentive to modify underwater loans since the renters have a right to stay in their homes.

There are likely some downsides to this and those ought to be explored. The most interesting effect would be a major – and as far as I am concerned, a welcome and overdue – shift away from a sole emphasis on homeownership to provide housing and economic security for Californians.

It is long past time for us to see renting as a desirable method to provide stability and savings for Californians. We have eviscerated rent control and allowed urban areas to make renting an insecure proposition. Given the sky-high costs of houses in places like San Francisco or Monterey (homes on my street still sell in the $700,000 range, although my rent is $1100) renting is the only way for many folks to live near their workplaces.

A “right to rent” could be a component of a broader policy shift away from pushing people to “drive until you qualify” and buy a home in Modesto or Moreno Valley and commute to their jobs in the coastal centers. That has been a utterly ruinous policy from an economic and environmental stance. It’s time we explored rent as a solution to the housing crisis.

1. I cut my teeth on representing banks during the FSLIC days. They always worry about tenants trashing the place — the legal term is “waste” — and there would need to be some sort of assurance in that regard. I suspect the bank will also want the right to sell the property while the tenant lives there, which means a “no right to quiet enjoyment” clauses in a rental agreement.

2. Beyond waste, you will get enormous pushback from banks. Calculated Risk had some posts (last week, IIRC, but everything pre-NN09 is now a big blur) explaining that even with modification programs and the like, banks were still better off financially by foreclosing than by doing loan mods/workouts.

3. From an economic blog, some Presidential serious news (Obama shifts away from “ownership society” and returns to renting) and some funny graphs: http://globaleconomicanalysis….

Warning: conservative comments abound.

4. Market price for rent: think that one through. There’s usually a ratio, 5% IIRC, of rent-to-home-price, so a condo worth $300K should rent for $1500. (In my neighborhood it rents for $1750, go figure.) If the condo was selling for $500K (which it did 2-3 years ago), and Octavia Owner bought for that price but is now facing foreclosure, should the market price be $1500, 1750, or 2500? If anything less than $2500, expect the bank to scream.

5. It was a pleasure meeting you at NN09!

Here’s why I hate this idea. This is more or less what the banks did to farmers 100 years ago. When the market killed the crop prices, the banks foreclosed on the farmland but were willing to let the farmers stay on as tenant farmers, since most bankers can’t farm.

Under this proposal, a whole class of “tenant farmers” would be created that may have a brief period of security, but now have little incentive to improve the property.

Is this better than nothing? Yeah, probably. It’s a triage type move as you suggest. The best policy is to allow cramdowns in bankruptcy.

This can be helped on the state level by simply upping the state-level exemptions that apply in bankruptcy or against judgments. But the cram down is really the first step. The fake fear of this disrupting the housing market is just lobbyist bullshit.

If that’s really off the table forever and all time, then I guess a right to rent is better than nothing.

This is what thirty years of conservative (and neo-liberal) economics gets us, at least for homeowners. I’m 23, and it seems more and more like the idea of home ownership for my generation will remain just that. An idea.

In the meantime, though, it seems I’ll be a renter for the rest of my life.

http://www.washingtonmonthly.c…

Don’t want to say I told you so, but…