The argument for single-payer health care is primarily moral. It’s just wrong to make anyone’s ability to get the health care they need dependent on their ability to pay.

Still, even when we win the moral argument, we still have to figure out how to get the system up and running – and how to fund it. It’s a sign of just how quickly the politics are moving on this in California, as the single-payer debate is increasingly about “how” and not “whether.” As will be shown below, the first analysis out of the state legislature suggests that single-payer would cost Californians just a third of what they currently spend on health care – and likely even less.

To that end, the Senate Appropriations Committee published today their fiscal analysis of Sen. Ricardo Lara’s SB 562. The headline that the media has run with is that the total cost would be $400 billion per year, and the state would need to cover about $200 billion of that cost (the other half comes from existing health care spending). Due to other savings, they conclude that “total new spending required under the bill would be between $50 and $100 billion per year.”

The analysis doesn’t make clear exactly how that sum was reached. But $400 billion is 16% of California’s overall GDP of about $2.5 trillion. That is in line with the current percentage of GDP that the United States as a whole spends on its inefficient, privatized health care system in which many people don’t get the health care that they need.

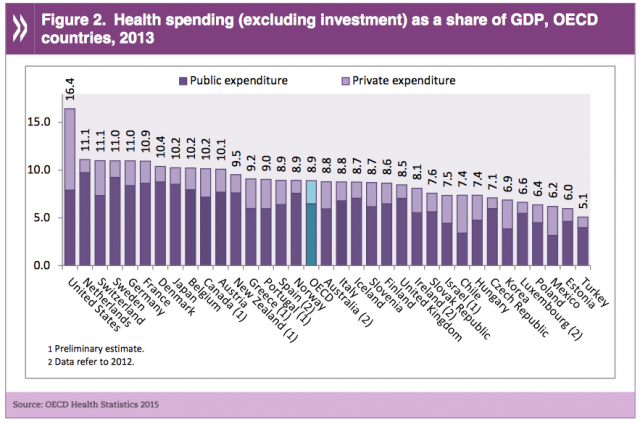

As the Senate Appropriations analysis notes, however, that $400 billion sum is about twice the amount spent in other industrialized nations. The Organization for Economic Co-operation and Development (OECD) published an analysis using 2013 numbers that showed the average percentage of GDP for health care spending in an industrialized nation is half the sum of the United States – about 8.9 percent.

Canada is a useful point of comparison, as a fellow North American economy with a population similar to that of California (36 million in Canada, 40 million in California). The OECD reports they spend about 10% of GDP on health care. In 2016, Canada’s actual sum spent was $228 billion.

So it stands to reason that a California single-payer system would be cheaper than the Senate Appropriations analysis assumes, and their figure should be considered as conservative.

But let’s say they’re right and the cost is closer to $400 billion overall, and that $100 billion in new revenues is needed (the high end of their $50b-$100b scale). That would pencil out to a monthly cost to each Californian of $208. ($100 billion / 40 million = $2500, which is the annual sum; divide that by 12 and you’re at $208.)

The average monthly premium for a Californian, as of 2016, was just under $600. For a household, it’s just above $1600.

In other words, even assuming the fiscally conservative analysis of the Senate Appropriations Committee and spreading the cost evenly across every Californian, single-payer would cost a third of what it currently costs Californians – just for health insurance alone. And unlike the present system, this would mean Californians don’t have to pay anything else beyond that $208/mo. No copays. No co-insurance. No out of pocket costs (at least within the Golden State). The ultimate savings would therefore be even greater. Californians could wind up paying just a quarter of what they pay now, if not less.

Of course, you wouldn’t actually pay for single-payer by levying just a flat fee across the state. A low-income family would pay far less in taxes than a wealthy family. The Senate Appropriations committee assumes using a 15% payroll tax to pay for single-payer, but there’s no reason we have to actually do it that way. A mixture of corporate and income taxes, especially geared toward the higher end of the scale, could bring down the cost to the median-income household even more.

Finally, the analysis notes that this would require voter approval because of the idiotic Gann Limit adopted in 1979 in the wake of the passage of Prop 13. If this does go to voters, I’d love it to be in the form of a constitutional amendment that, among other things, eliminates the Gann Limit for good.

The media will crow about the cost of single-payer. They should be emphasizing the savings. And we as activists should bring it back to the moral argument. If you can guarantee health care to every person in California as a right of being alive, and do it so for no more than a third of what people spend right now, why the hell would you say no?

Your numbers are very close to what I came up with 15 years ago.

Single payer is the way to go: cheaper, more equitable, definitely more Christian in the best sense of the word!

I wonder if the appropriations committee took into consideration the fact that medical treatment is much more costly when postponed. If preventative care were available to everyone, many cases that now wind up in the Emerency Room and ICU would be resolved by a timely office visit at a vastly reduced cost. In time, redundant and costly facilities could be consolidated and money saved. Also, lost productivity due to untreated chronic illness and resultant absenteeism would be reduced and the economy would benefit. I can think of many more indirect benefits. if legislators still think single payer universal health care is “too expensive”, they just aren’t focused on the cost of not having it.

With single payer, you’d be removing all the profits from the insurance companies and their upper managements’ massive compensation packages … so, obviously the cost of healthcare would be less. Math, people.

“The problem with socialism is that sooner or later you run out of other people’s money.” Margaret Thatcher

Let’s try it and see. There is no shortage of money, just in people willing to pay their fair share. Wealth is power and you can never have enough. It’s all about the 1% keeping the power and sucking any power they can from the 99%.

“The analysis doesn’t make clear exactly how that sum was reached.” Directly quoted from the article. This is how “fake” or innacurate news is spread. Developing an argument stated as fact, when in fact, the basis of the entire article proves itself baseless. It’s unbelievable.

Whatever’s become of Vermont’s single-payer plan?

It picked up a lot of steam, but then was kiboshed by the Democratic governor.

After that … crickets.

What gives?

We already have what I consider the basic right to healthcare. It’s called the declaration of Independence and it’s inalienable rights; specifically, the one called life. These rights were intended to be the basis of any government formed as a result of this proclamation of freedom and democracy.

The problem is that we have become an oligarchy and that much of said oligarchy prefers not to recognize the legitimacy of our founding document, as all oligarchies would tend to do. To them, rights cost too much and are very bothersome things.

Single-track health care is the only way to go to provide care for ALL of our citizens.

WISH I lived in CA still!!! This makes way too much sense for the rest of this country to go along with! ?

Why haven’t we done this years ago?!?

Oh, yeah… that’s right… Our elected representatives have been bribed so the 1% can keep raping us…

I have a question about this bit:

“That would pencil out to a monthly cost to each Californian of $208. ($100 billion / 40 million = $2500, which is the annual sum; divide that by 12 and you’re at $208.)”

That $100 billion is just the additional funds, isn’t it? So shouldn’t it be $400 billion / 40 million = $10000? Taking existing costs into account?

That would lead to a monthly payment of about $833, which is more. Not a LOT more, considering the additional benefits, but it’s still not a third of existing costs.

Your math is correct. But the $10000 is per person. For a family of four that works out to $40000 per year!!!! If one believes that the the government can provide health insurance with no copay or no deductible for $ 208 a month you probably also believe in the tooth fairy too. Remember the government system would not be very efficient and would have a lot of hidden cost . If the single payer system seems to good to be true it’s because it’s not true.

Single Payer would provide aspirin for those needing triple bypass surgery.

As long as we allow the insurance companies to make donations to members of congress the insurance companies will write the rules.

I don’t understand your math/logic. If Californians spend $400 billion per year, isn’t their cost $10,000 per individual per year, or about four times the $208/month you indicate?

Insurance is the biggest crime being perpetrated on the American people.

When we talk about savings from single-payer, where do those savings originate? I.e. who’s getting paid less? Is it the doctors? The hospitals? The insurance companies? I’m more than a bit skeptical of magic asterisks.

Why can’t this be done for every state? We, American citizens, have a right to have good insurance and with no co pays, no coinsurance and no out of pocket costs for a low monthly payment. I get $666 monthly from my social security and with medicare which don’t pay hardly anything, I have to get a prescription insurance, another supplement insurance to help take care of the left overs from medicare, and had to get a separate dental insurance. I now pay over $300 for insurances! Is that right??? NO, IT’S NOT!!! My medicare cost $123 monthly, but I have to pay all the other insurances monthly too! NOT RIGHT!!!

I only had to pay around $40 a month for a good insurance with Obamacare and I was happy with that. Then medicare signed me in and I had to cancel my insurance and them take $123 a month for stupid medicare which don’t pay crap.

Something needs doing to help all the states and all of us who aren’t wealthy and just barely getting by. No vacations, no dinners out, no entertainment of any source because we cannot afford it. It is so hard for us to come up with property taxes, homeowners insurance, life insurance and auto insurance or emergencies with no more than we get from our social security retirement.

Please help California and my state of North Carolina, and all the states of the US. PLEASE.

Sincerely,

JoAnne Coleman

PO Box 96

Lowgap, NC 27024

Single payer also transforms who we are as a society. You’re not stuck in a job you hate and are unsuited for because you need the health insurance. When you can’t work for an extended period due to illness, you don’t also lose your health insurance. Artists with health care, servers with health care, retail clerks with health care. Changing jobs or even professions? Same health care. When someone in the household is really sick, you don’t try to wait it out because you can’t afford another co-pay. It’s amazing how much less fear and tension exists in single-payer society.

Now why haven’t I seen this article in my newspaper (The Sacramento Bee)? Has this article been shopped around to the newspapers?

NO!!! comes from the profiteers in this market place called insurance companies and their puppet politicians.

A single payer system should be graduated upwardly; that is, higher income people pay more & lower income pay less or nothing at all. Everyone would have access to the best heathcare possible, and you would only pay based on your ability to pay.

Yes

Civilrightsforseniors.com continues to speak on this topic

My local paper, the Press Democrat (Santa Rosa) did just what you said, editorialized the cost without mentioning the savings!

http://www.pressdemocrat.com/opinion/7036328-181/pd-editorial-state-cant-afford

In Canada when Health Care became available for us, a sales tax was put on our purchases – that was in the 1950’s. Here it is 2017 and I am a senior – I do not pay for Health Care except $4.11 on each prescription that I have filled. We do have long waits to get to see a specialist but if that is my only complaint, I think I am very fortunate.

I did leave a comment.

Health care should be the right of every person. It has been demonstrated in at least 58 other countries that it is an obtainable goal. It’s time to love and care for our fellow man. Comments such as the rich don’t want to support the poor are unacceptable. It is not a matter of rich or poor ; it is a matter of caring for all humanity.

Corporations need to be taxed at much higher rates. Maybe 75% or so. Threaten them with state takeovers if they fail to comply. Frankly if Google, Uber, or Facebook want to leave, good riddance to bad trash. The tax structure is going to have to change if we want health care and education systems for everybody which is the moral and economic thing to do. It’s a travesty that we have to “vote” on life and death matters like this, or civil rights like Prop. H8. More reasons to overthrow capitalism.

But if single payer passes, the next stop is single payer college. That’s what the ruling class is afraid of, “giving” too much away.

If they would eliminate the provision covering illegal aliens, I would support the provision.

I would not agree with your figures or conclusions. The reason NOT to do it is the cost in increased taxes to those already very burdened by the progressive system in California. I believe it is unfair to make those persons pay for the costs of treatment for indigents that are themselves to blame for their poor health (smokers, drug addicted, etc). The better answer is to drive down the costs of care with tort reform, competition, and health maintenance.