The California Budget Project released a report on Friday entitled “Budget Cuts or Tax Increases: Which Are Preferable During an Economic Downturn?” Their findings? Well, let’s just say their findings have proven the Republican minority wrong once again. “Carefully chosen tax increases are preferable to cutting public spending when the economy is weak.”

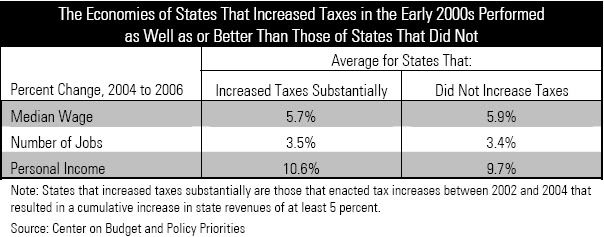

The economies of states that substantially increased taxes in recent years performed as well as or better than those of states that did not. States that enacted large tax increases between 2002 and 2004 – increasing state revenues by at least 5 percent – subsequently experienced stronger average growth in personal income than states that did not increase taxes at all. Additionally, average job and wage growth was essentially the same for states that increased taxes the most during this period as it was for states that did not increase taxes. Moreover, states that raised taxes substantially are considerably less likely to face budget shortfalls this year than are states that did not.

But is the opposite true? Well, pretty much yes.

The economies of states that enacted large tax cuts in the late 1990s and early 2000s performed worse than those of other states. States that enacted large tax cuts between 1994 and 2001 – reducing revenue by at least 7 percent – subsequently experienced weaker growth in jobs and personal income and larger increases in the unemployment rate, on average, than other states. Furthermore, the states that enacted large tax cuts faced larger budget shortfalls when their economies weakened.

In the meantime, Assembly Budget Chair John Laird (D-Santa Cruz) released the Assembly Budget Committee’s Conference Report on the 2008-2009 State Budget earlier today. The Conference Report calls for some budget cuts but proposes $8.2 billion in increased tax revenue to balance California’s budget without drastically cutting public spending on vital services. The CBP report gives ample justification for the approach that Laird and the Assembly Democrats are recommending.

According to Nobel Prizewinning economist Joseph Stiglitz, when the economy is weak, “economic theory and evidence gives a clear and unambiguous answer: It is economically preferable to raise taxes on those with high incomes than to cut state expenditures.”

State spending reductions could further exacerbate the weak economy. Consumers buy less and businesses produce less when the economy is weak. Therefore, the key to promoting the state’s economic growth in the short run is to encourage spending on goods and services. Stiglitz writes: “In a recession, you want to raise (or not decrease) the level of total spending – by households, businesses and government – in the economy. That keeps people employed and buying things, and makes it more likely that businesses will want to invest to serve that consumer demand.” However, state spending reductions have the opposite effect: Each dollar less that the state spends generally reduces consumption by the same amount.

Penny

Online Organizing Director

California Democratic Party