(Excellent stuff from the Democratic candidate for AD-70 – promoted by Robert Cruickshank)

I was recently asked by the Orange County Register to give answers about how to fix the California budget in 75 words.

I was recently asked by the Orange County Register to give answers about how to fix the California budget in 75 words.

That is not possible, because it’s a complicated issue.

Of course, I could have pretended it was simple, like my opponent will do, by blaming California’s budget problems solely on government spending.

But that is not the case.

California has the second lowest ratio of state employees to population among all the states, with 103 full-time equivalent state employees per 10,000 residents. The national average is 143 state employees per 10,000 residents.

It isn’t excessive spending that is the real culprit causing our budget woes – it’s the reckless borrowing we’ve done to pay for unfair tax cuts to the rich and giant corporations.

The three main causes of California’s budget crisis are (1) the national recession, (2) the billions of dollars in tax cuts given to the wealthy and giant corporations, and (3) the billions of dollars in interest that California must pay for the money borrowed to cover these unfair tax cuts to special interests.

If you want to see why people get confused about the causes of our budget problems, break down this whopper from the website of Jerry Amante, one of the Republicans campaigning in the 70th Assembly District, where I’m running:

Over the last 20 years, the California Consumer Price Index has risen 44% and population has increased by 20%. During the same period, state spending as (sic) increased by 262%, from about $40 billion to $145 billion. This huge expansion in the size of state government is the root cause of our budget problems. The solution is not to raise taxes so the government can keep growing – it is to rein in spending and limit government growth. I support a constitutional amendment to limit spending increases.

I don’t know where Amante gets his numbers.

The California Consumer Price Index has risen 72.1% from December 1989 to December 2009, not 44% as Amante claims.

Population has increased by 28% from 1990 to 2009, not by 20%.

(It’s pretty easy to Google this stuff.)

Factor those two numbers together (population and inflation), and you see that if spending had remained level per person, state spending adjusted for inflation would have had a natural increase of 220%.

Jerry Amante was either just plain wrong or intentionally dishonest in his numbers about population and prices, leading to a gross distortion of the growth of the California budget relative to population and cost of living.

How did he do on his spending numbers?

He got one number right: state general fund spending for 1989-1990 was $39.5 billion, very close to Amante’s $40 billion number. But state general fund spending in 2009-2010 was $86.1 billion, not the $145 billion that Amante claims.

Maybe Amante meant total state spending, including special funds and bond funds, but then he should have used $48.8 billion as his number from twenty years ago and a current number of $124.7 billion.

But whatever numbers Amante uses, the fact remains that real general fund spending has increased less than half of one per cent per year over the last twenty years.

Total spending has increased by more, driven by reckless borrowing under GOP Governor Schwarzenegger, so that bond payments have increased more than 400% from what they averaged twenty years ago.

Much of that irresponsible borrowing has been to pay for tax cuts. While general fund spending has been relatively level, the cost per year of the tax cuts enacted since 1993 has risen to $11.7 billion a year. Just the 2008 and 2009 tax cuts for giant corporations will cost the state nearly $8 billion over the next eight years.

If you are asking, “What tax cuts?,” you’re not alone. You probably haven’t seen these tax cuts, since the constant shift has been from taxing corporations and the richest Californians to taxing the middle class, primarily in the form of increased sales and income taxes, but also through higher fees, much higher tuition and service cuts.

California also lost $1.2 billion dollars a year when Republicans irresponsibly took away the provision that allowed for a California estate tax that was fully deductible against federal estate taxes.

So does California primarily have a spending problem, or do we have an acute tax fairness problem and a reckless borrowing problem?

We do have a huge revenue problem as the recession has seriously cut into the state’s income and sales tax revenue. California’s problem is worse than other states because we came into the recession already crippled by Arnold’s ill-considered tax cuts and the reckless borrowing needed to pay for them.

Most Californians agree that we need to restore the cuts made to education, continue to provide vital and cost-effective health services for our seniors so they can live with dignity in their own homes.

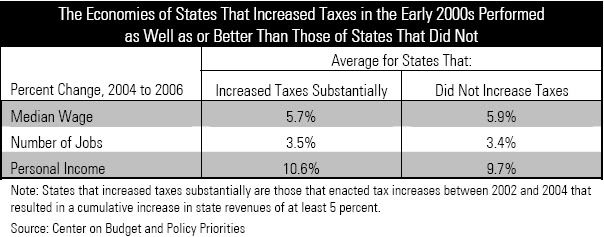

To protect our schools and our seniors, we need to stop the borrowing, roll back some of those corporate tax cuts and let the banks, oil companies, and giant corporations pay their fair share.

The California Budget Project has done some great work in analyzing the state budget issues, and bringing to light some of the myths that are constantly thrown around. If you want to compare myths and facts, take a few minutes to read their great analysis.

Don’t believe the myths.

To fix the budget, we need the facts.

PS Remember that I’m hosting coffee at the CDP convention. See my over-caffeinated blogad on the right side of the page.