by Brian Leubitz

The concept of Ranked-Choice voting has been around in several major cities in California for over a decade. In San Francisco, it was approved as Prop A in 2002. So, it is far from new. Yet, it still never ceases to provide interesting results, and a fair bit of outrage. Of course, the the most well-known example is the case of Jean Quan’s victory in Oakland over Don Perata. Before the RCV shifted votes around, Perata had over a third of the votes, over 10,000 more than either Quan or Rebecca Kaplan. Kaplan was in third place after the minor candidates were shifted, and most of her votes went to Quan. Many, including Perata, were outraged. There was outrage that the candidate with the most 1st place votes didn’t win. There was outrage that Quan and Kaplan had been stating that their supporters should vote for each other number two, as if they were “ganging up” on another candidate.

Fast forward to 2018, and it appears that the controversy has just moved across the Bay to San Francisco. The Mayoral election to replace Mark Farrell, the interim mayor chosen by the Board of Supervisors after Ed Lee’s sad and surprising passing, has three candidates with a chance of winning. Former Senator Mark Leno, President of the Board of Supervisors London Breed and Supervisor Jane Kim all have met the public financing requirements, and are all polling relatively close. Polling in SF is pretty hard with low response rates, especially considering the recent rash of spam calls, and many of the polls seem to have some sort of bias. But the basic state of the race seems to have London Breed in front, with Leno slightly behind, and Kim in third. The numbers vary from poll to poll, but the basic state of the race seems somewhat stable.

And this brings me to this tweet and video:

The billionaire in question is Ron Conway, an “angel investor” with a lot of money in various tech companies in the Bay Area. He was one of the largest funders of Mayor Lee, Asm. David Chiu and Sen. Scott Wiener through direct contributions as well as PACs and IEs. And now he and his wife Gayle are supporting Board President Breed, which has become quite controversial.

But putting that part to the side, this is ultimately a direct result of ranked choice voting. On the 2002 ballot arguments in San Francisco, supporters and opponents acknowledge that RCV would reduce negative campaigning so as to not alienate voters who supported other candidates first. This is simply one step further, with campaigns advocating to support one of their rivals second.

But the San Francisco Chronicle is having NONE. OF. IT. In an editorial entitled “Jane Kim, Mark Leno try to game the system in SF mayor’s race”, they argue that this is simply not fair:

The Kim-Leno collaboration shows the continuing determination of the progressive factions to keep Breed out of the mayor’s office. It also projects an element of desperation by Kim and Leno. Their new “stand up to the billionaires” 30-second video shows that no dose of demagoguery or disingenuousness will be spared in trying to stop Breed, who grew up in poverty and has repeatedly demonstrated both her independence and ability to build coalitions as president of the Board of Supervisors.

Oh, did I mention that the Chronicle endorsed Breed? Probably didn’t take too astute of an observer, but they have previously gotten in trouble for some questionable reporting practices. And for my part, I should disclose that I am a supporter of Sen. Leno. (He performed my wedding ceremony, in fact.) My political club, the Alice B Toklas LGBT Democratic Club endorsed Leno first and Breed second. We understand that in a RCV environment, it makes sense to have more than one endorsement. The progressive organizations of which the Chronicle is speaking see this too. Many of these organizations prefer Jane Kim, but they would rather see Mark Leno in office than London Breed, or vice versa. And perhaps that is also true of these two candidates themselves.

If there were a runoff, would anyone begrudge either candidate for endorsing the other? Would the Chronicle accuse them of “gaming the system?” I mean, isn’t this how primaries work? Bernie Sanders endorsed Hillary Clinton. Was he gaming the system?

In San Francisco, and other RCV cities, we only have one election, rather than a primary and general. So the only way to make this type of statement is to state that you prefer one candidate over the other.

This isn’t “gaming the system.” This IS the system that San Francisco voters supported, for better or worse, in 2002. This is precisely what the ballot arguments envisioned. If the Chronicle would like to change San Francisco’s voting, I think you could find a lot of support for that idea.

Until then, don’t hate the players. Hate the game.

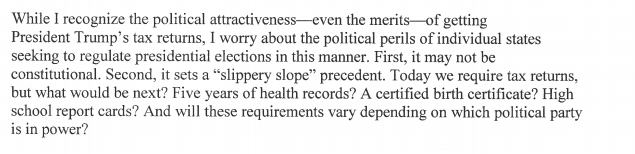

Rep. Mark Takano on Speaker Ryan’s plan – (D-Riverside)

Rep. Mark Takano on Speaker Ryan’s plan – (D-Riverside)

You must be logged in to post a comment.