Originally published in the Sacramento Bee on Sunday, January 12, 2014

No political consultant sees more angles than Richie Ross, but his tangent opposing two pro-consumer ballot initiatives, which could turn 2014 into the Year of the Patient, is unsound geometry (“Voters can’t avoid health care politics,” Jan. 2). The ballot measures will save lives and money by closing fatal loopholes in Obamacare and California’s patient-safety laws.

No political consultant sees more angles than Richie Ross, but his tangent opposing two pro-consumer ballot initiatives, which could turn 2014 into the Year of the Patient, is unsound geometry (“Voters can’t avoid health care politics,” Jan. 2). The ballot measures will save lives and money by closing fatal loopholes in Obamacare and California’s patient-safety laws.

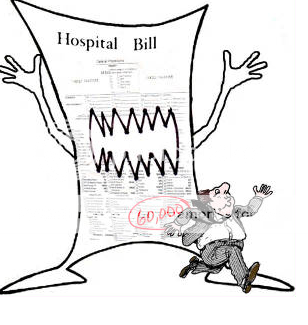

The Affordable Care Act requires everyone to buy insurance but does not limit its cost. The “Justify Rates” ballot initiative before voters in November requires California health insurers to justify rate hikes and get approval before they take effect, as now happens in 35 other states.

The millions of individual policyholders and tens of thousands of businesses whose rates could not go up without state approval under the measure are those who have been hardest hit by premium increases over the past decade.

The ballot measure applies California’s tough property casualty insurance regulation, enacted by voters in 1988 as Proposition 103, to health insurance. A recent study by the Consumer Federation of America found the law has saved California drivers $102 billion. Drivers today pay less in real money than they did in 1988, the only state to see any decline.

The same tough rate regulation already applies to medical-malpractice insurance for physicians and hospitals, including that paid for by private clinics.

Consumer Watchdog has used the law’s protections to lower medical-malpractice insurance premiums by $77 million over the past decade. Ironically, doctors enjoy the protection that millions of Californians who pay for health insurance don’t yet have.

That’s why arguments that the Troy and Alana Pack Patient Safety Act, now circulating, will raise malpractice rates are phony.

This ballot measure will save lives by curbing substance abuse by doctors, stemming the tide of overprescribing, and updating a 38-year-old cap on victims’ recovery that prevents injured patients from getting justice.

The California Medical Board estimates that 18 percent of doctors have a drug or alcohol problem during their careers. Mandatory drug testing, as now applies to most other public safety professions, will prevent dangerous doctors from practicing. Updating our medical-malpractice laws will allow victims of drugged, drunk and dangerous doctors to get justice.

One quarter of all medical discipline in the state involves abuse of drugs or alcohol. The Pack Patient Safety Act will protect the victims of this abuse and their families from the third leading cause of death in America: medical malpractice.

Jamie Court, proponent of the initiative requiring public justification of health insurance rates, is president of Consumer Watchdog. Carmen Balber is the nonprofit group’s executive director.