The CA-32 race to replace Labor Secretary has less than six weeks to go until the primary. We know about the two major candidates; Board of Equalization member Judy Chu (not to be confused with Betty Chu, who will appear directly above her on the ballot and surely cause some errors among voters) and State Senator Gil Cedillo, whose extreme spending of campaign contributions on shopping, meals and lavish hotels made the LA Times this weekend and caused a stir.

Somewhat less remarked-upon has been the candidacy of Emanuel Pleitez, a product of East Los Angeles and Woodrow Wilson High School, who matriculated at Stanford, joined the advisory board of Voto Latino (a group that encourages voter registration and engagement for the Latino community), worked for Democratic lawmakers like Antonio Villaraigosa, Tom Daschle and Hillary Clinton, and worked on the Obama transition team at the Treasury Department. On Friday I had the opportunity to chat with Pleitez about his life experiences, the financial crisis, housing policy and a host of other issues. A paraphrase of that conversation follows.

(As a side note, this story about one of the volunteers on the campaign, who traveled all the way from Santiago, Chile to work on it, is pretty amazing.)

Calitics: Tell me about your experiences that have brought you to this run for Congress.

Emanuel Pleitez: You know, after college and working in the private sector at Goldman Sachs, I was able to travel a lot. And I think visiting 27 countries gave me a new perspective on what the challenges are out there in the world. When I would go to South Africa or India, China, Brazil, I would visit the universities, and the slums, and see their struggles, and it really made me think about the issues of global poverty. I even drove a taxicab in Myanmar! And what I took away from all that is that the best way to create change is to start in your own backyard. And that’s what we’re doing in this campaign.

Calitics: So how are things going?

EP: Well, we have 25 full-time staff working every day. And our main focus is door-to-door, face-to-face contact. We’re out canvassing every day. A lot of people tell me that they think we’re the only candidate in the race, because we’re the only one they see. So we feel pretty good about our position.

Calitics: Now, you worked on the transition in the Treasury Department, and one central concern that a lot of people have had with Treasury is the lack of staffed positions at the undersecretary level, and the belief that Tim Geithner has basically had to go it alone over there. How should people look at the transition’s performance in that respect?

EP: I agree with that criticism of Treasury. I had nothing to do with personnel, I worked in other departments. But there are many reasons for the lack of senior staff, and I wouldn’t discount the ability and importance of the career civil servants working in the Department, who are doing a fantastic job.

Calitics: This week, the Congressional Oversight Panel released a preliminary report on the TARP program and Treasury’s performance, and they were highly critical of the lack of transparency and clarity over some of these programs, as well as a lack of accountability for the big banks. How would you assess the various programs offered to this point?

EP: I don’t have all the details of the COP report. My inclination is to defend Secretary Geithner, but I want people to be critical. I think what he’s trying to do is return confidence to the markets and get credit flowing again, and we’re seeing signs that the plans are starting to work.

Calitics: How would you approach the situation with the banks. Would you just recapitalize them forever, or seek a Swedish-style receivership or a liquidation of the insolvent firms?

EP: I would consider a receivership, but I wouldn’t make that the first thing on the table because of the expense involved and the danger to the markets. But clearly, recapitalization alone won’t work, that’s just making capital disappear.

Calitics: What’s the biggest problem in the economy that we’re facing at this point?

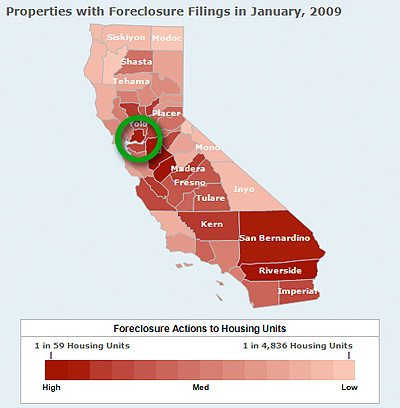

EP: The biggest problem is the foreclosures right now. Some of them are in rural districts are suburbs and they’re second, third and fourth homes, but for families in urban districts like mine, a foreclosure means the loss of everything you’ve got.

Calitics: Would you support bankruptcy judges being able to modify the terms of a primary loan for borrowers? Isn’t there a problem with modifying securitized loans, in that the people holding the securities that have been modified can sue the loan servicers for illegally changing the terms of the security?

EP: That is a problem. But as I understand it, cram-down is more of a threat to incentivize loan modifications and keep people in their homes. Which is what we have to do. Investors will get hurt anyway if the loan forecloses. Somehow, the lenders and the investors and the home-owners have to come to an accommodation, and in that process the primary goal should be keeping people in their homes. I wasn’t initially open to principal write-downs, but I am more so now, because we’re seeing that the interest-only modifications are not working, and people are being forced into foreclosure just a few months later.

Calitics: What are some of the other challenges facing the economy that you want to deal with in Congress.

EP: Obviously, we still need major stimulus to save jobs and transition into a new economic future. A large part of my district is at or near the poverty rate, and we need help in these tough economic times. I expect another trillion dollars to be spent by the government. In my district, we need investments in public transportation and clean energy programs to reduce emissions and create manufacturing jobs. There’s a program here called “La Causa,” which targets the high school dropout rate, and gets those kids into vocational programs for green jobs, whether it’s solar panel installation or something like that, so that they can be prepared for the 21st century economy. We need more of that. And we need investment in education, because any dollars spent get the greatest return in education.

Calitics: Do you plan on joining any ideological caucus in Congress?

EP: I haven’t really given it much thought, but I don’t think so. I think all political is local, and I’d rather focus on helping my local community and responding to the concerns of my district. Maybe I’ll join the Congressional Hispanic Caucus, that should be safe for me. (Laughs.)

Calitics: Well, thank you for talking to us today.

EP: Thank you.